As I indicated only recently in the article "no idea what money is anymore", the quest to understand money is a never ending one. You think you get it, but then the rules get changed. The two guys in command of the World Order (the King of US and his puppet the Chairman of the Fed) either create another acronym at the end of each week in their soup of alphabet, to hide their money market manipulation, or make the interest you earn on saving become negative, or push asset valuations off-chart, or manipulate whatever else that makes you think... Do I really know what money is? 🤷

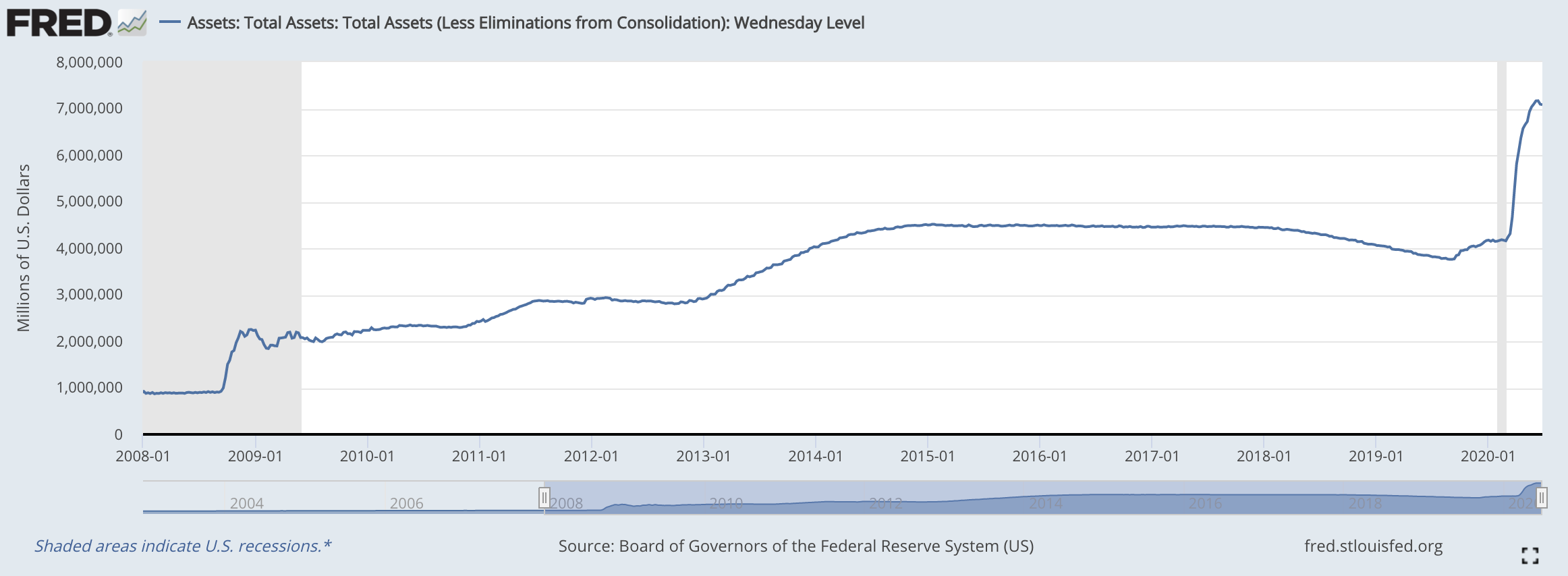

This article is likely to be the first of a few upcoming ones, as I will not give you all the money secrets in a simple 5min read. With the Fed balance sheet now definitely over $7 trillion (from a base of $1 trillion only 12 years ago...) I thought that we had to go back to some basics. Which -flation are we going to be hit with? They are creating massive inflation, aren't they? Even Tom last week wondered if USA is not preparing a remake of Greek hyper-inflation, let alone a 1920s German-style money destruction! Looking at the picture below, we really have to ask this question.

Before we even contemplate the various -flations, I would like to give you another little story. In the past 25 years, I unfortunately cannot recall of many vacations that I took. I don't complain, I inflicted this onto myself (and my family!). Always connected, always available... I was living in the world of fast and now. It was also the world of dreams and (false) promises.

Anyway... I remember that there was one week which came as close to a real vacation as I can possibly imagine. It was 6 years ago. We went to Croatia for a week, in the natural reserve park. The Balkan war had been history for 13 years already, but you would see houses with thousands of bullet impacts everywhere. And unfinished roofs! 😧 Basically, the 13 years were not enough to erase the pain inflicted by the war.

As part of our canoeing trips, we once crossed over into Bosnia. If you think Croatia was badly impacted by the war, wait until you get into Bosnia... As you look into the countryside, you see bullet-decorated houses scattered around, and local people getting together cutting wood, collecting fruits, making jam... It got me thinking... These people are living in a shadow economy. The state will not collect VAT on what they produce, as they produce for themselves. The state will not collect tax on income as there is no income. This economy is just about survival. How can this country raise to modern standards if it cannot collect money from its citizens? What happens when money does not circulate?

Today, 20 years after the war ended, Bosnia is credited with a GDP of $20bn. For a relatively similar population, that is 20x less than Ireland. Well, what about this one: an Irish teenager created a company is his bedroom, called Stripe, worth today $20bn, or the entire "financial size" of Bosnia. When money does not flow, the value of things collapses. But when money flows, even in your tiny bedroom, the value of things can go ballistic.

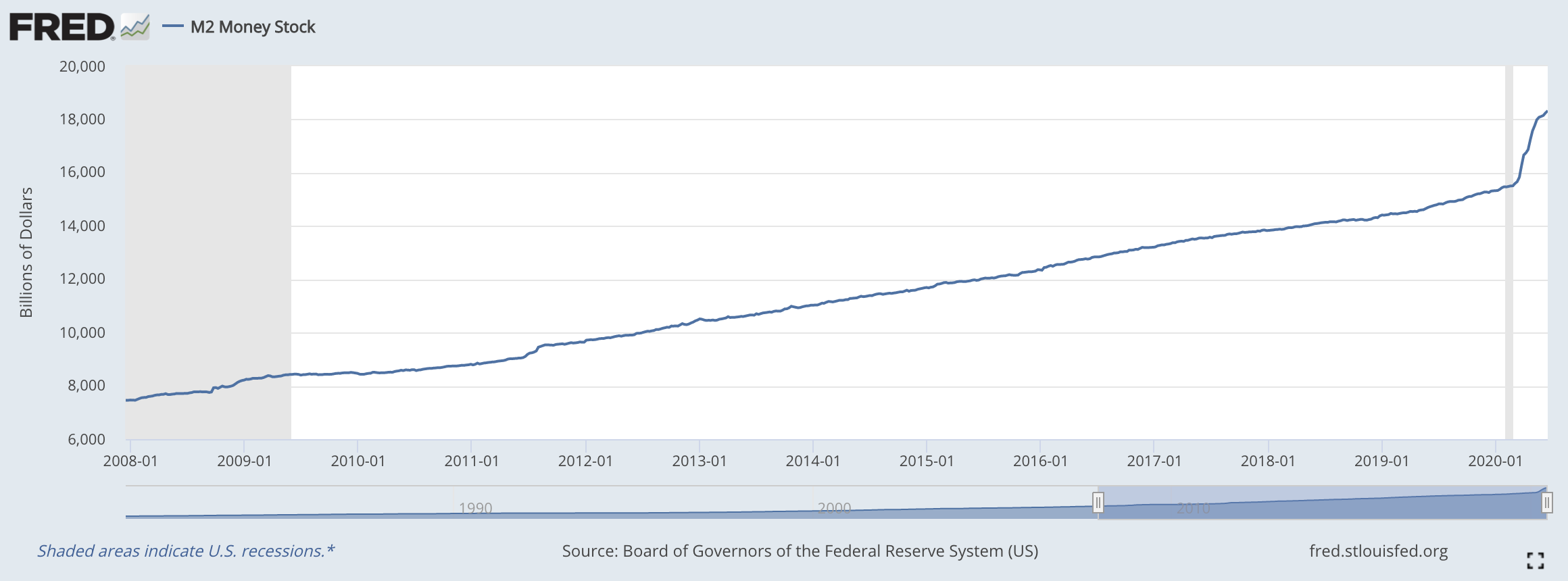

If we want to understand the value of things to come, we need to keep the flow of money in checks. There are concepts called M1 (basically the amount of cash in circulation, made of notes and coins) and then M2 (M1 cash + deposit at bank and savings accounts). To make it simple, M2, also called the money supply, is as close as the real money in circulation, as opposed to the fantasy casino money made of debt, and leverage on the debt, and leverage on the leveraged debt... 🥳

As we can see, whereas the Fed has multiplied by 7 its assets over 12 years (the previous graph), the money supply has had a more modest x2.5 in the same period.

This graph is important because behind the headline of the Fed printing to the Moon, in fact, the money in circulation is not so hyperbolic. We can see the impact of the recent $3tr Fed alphabet-soup-QE-is-not-enough money printing, but...

- it has less of an impact than on the Fed balance sheet, as there was a prior M2 stock already close to $16tr

- 😱 let's keep this for another time... it does not include any USD cash and savings parked abroad... Magic... ✨

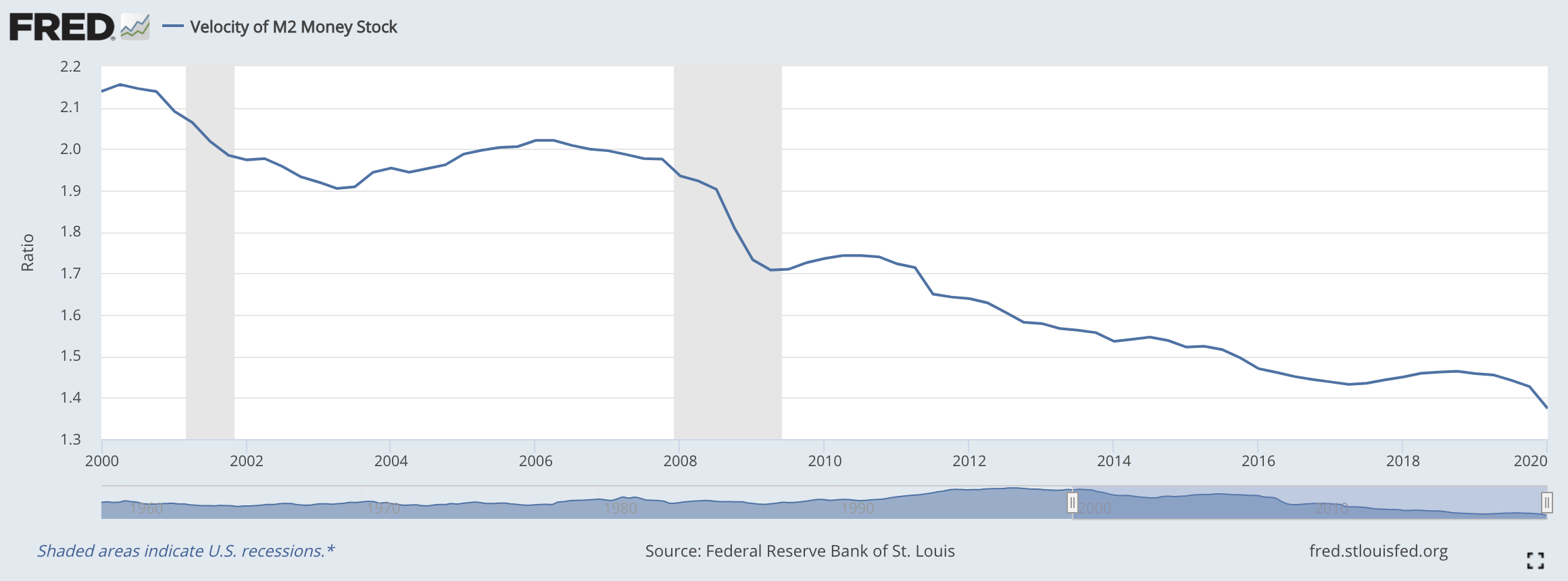

Finally, this concept of money supply brings us to the other concept of Velocity of Money, which is a country's GDP divided by its M2 money supply. The idea of velocity of money makes sense. The more the money circulates from hand to hand, the more likely the economy is in good shape. As money flows, more people get a little share of this money, even if temporarily. Likewise, the government can raise more taxes on each transaction, so that it can then redistribute the money to other persons in need (social programs) or political priorities (education, justice, military, pick your choice).

When you think about it, the velocity of money is paramount. No velocity = paralysis.

Well,the velocity of money has been in a natural downtrend for the past 20 years. This downtrend is just the consequence of the GDP growing very slowly (2-3% per year) and the money supply increasing faster (around 5-6% per year). However, this picture does not represent what is to come. Let's remind ourselves of a few recent facts:

- The Global Economy got stopped three months ago

- People were asked to stay home

- More than 40 million people got fired from their job, just in the USA alone

- People stopped handing their cash to each other

- In the past three months, the money did not circulate like it did at any time in the past 100 years

For many reasons, the near-term Velocity of Money will collapse. First, the GDP is falling, at a predicted rate of 53% in the USA in Q2. Then, in the coming months, people are very likely to switch into survival mode. When they do this, money will circulate a lot less to them and from them. If millions and millions of people move from spending habits to survival mode, the velocity of money of the whole economy will shrink. Big time!

So, for the first time, you will hear me say this: the Fed has now printed a few trillions, but it may just not be enough. It may not be enough to keep the GDP up, to keep the money flowing into the economy, basically to keep the Global Economy going. Because at this stage, they can print another 10 trillions, if the money does not circulate, the game is over.

At this stage, the Fed is really out of ammo.

At this stage, either the Kings reshape the world, or we may be in for a larger doom scenario.

You like this article? Please share it with your friends. I write for your benefit, not mine. Share it! 🙏

Follow me on twitter.

At this stage, I certainly do not want to draw any conclusions. The only thing I start to realise, is that this money printing... it is still not enough to inflate us all out of trouble. Until the economy gets back working again, or until another world order is put in place, with a new Landlord over the Lands and Oceans, there is absolutely no risk of any high inflation, let alone hyper-inflation. Yes, the local stuff will cost more, as per the de-globalisation. But this is a little side effect. This is not the macro trend.

At the moment, the macro trend is... velocity cratering 😳

To your journey!