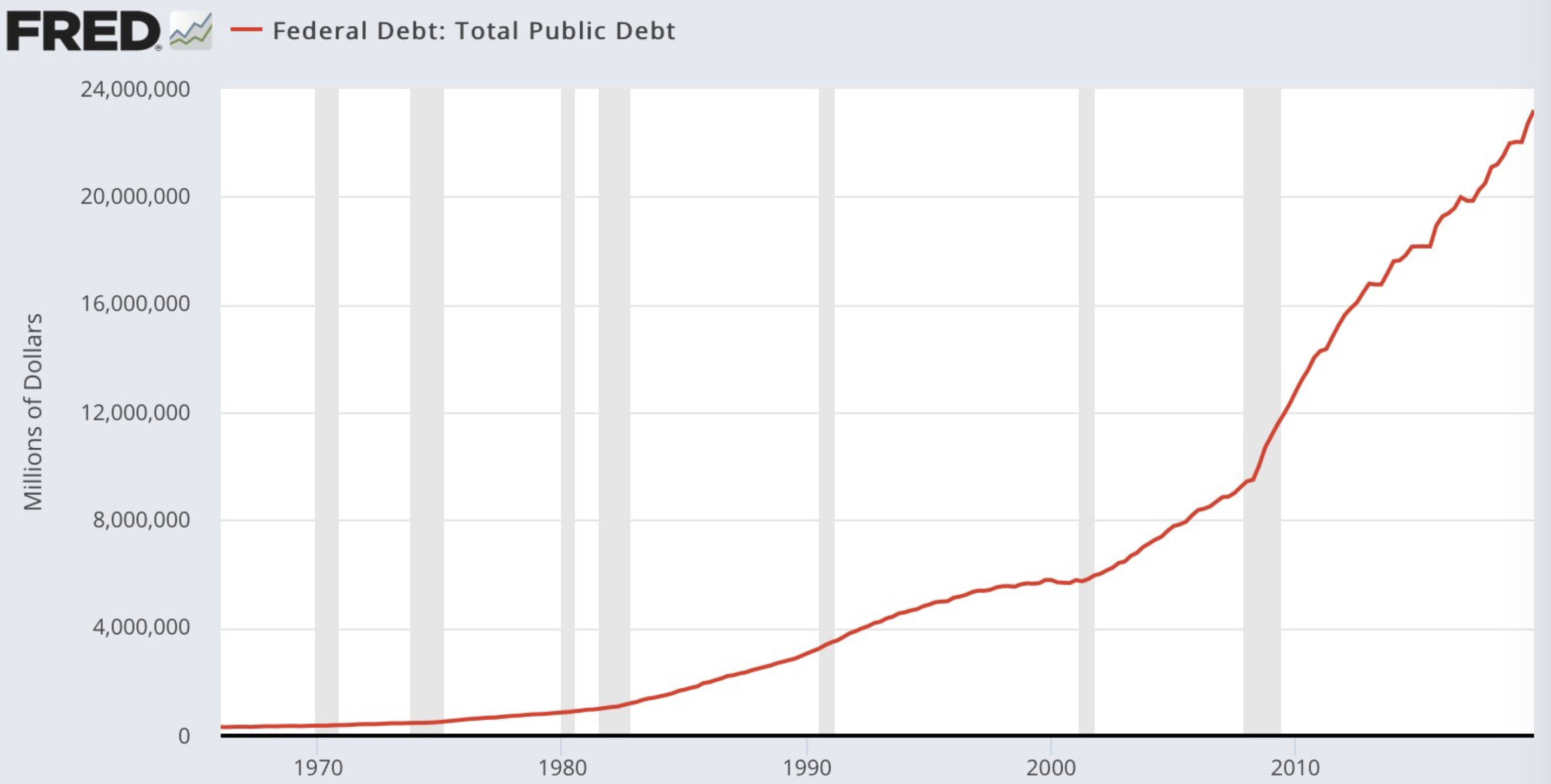

One thing is for sure. We are still in the washing machine at full speed. No, frankly, I have lost count. They voted $2 trillion, but in fact they mean $6 trillion and the total federal debt is hitting $27 trillion... Or something like this... I am really loosing track in this spinning world. Even the Federal Reserve's own websites is loosing track and still display a week old debt of $22.8 trillion... 🤦 Come on FED, update your money printing chart every hour or we cannot follow!

My best approximation is that as of today, the US debt puts a burden of around $80,000 on each and every American. That's on top of their personal debt, that's just to have the right to live there. At some point, they will have to pay tax in proportion of this to pay back their masters. I don't even dare calculate for Europe... And I don't dare think what this number will be in two weeks at this rate of growth.

One thing is clear, the FED is going all-in as the battling forces are supernatural both sides.

On one side, you have a few billion people who have stopped working for a few weeks maybe months. The economy is on cardiac arrest. That is the biggest down power that ever existed. It is dwarfing any other recession. In fact, it got faster on the downside than any other recorded recessionary event in modern times. The only approximate blueprint we have for this is the 1929 depression. Yes it's called a depression, not a recession. As we see, we are following the script, only a tad bit faster...

On the other side, you have the Central Banks printing like tomorrow does not exist and the Governments sending checks to the population at large. By the way, I just wonder if they will tax the favour by year end 😮. Now, the money printed is so mind boggling that inevitably, a lot of it falls in the hands of the most connected people. As happened during the 2008-2009 financial crisis, a few more very connected people and/or multi-billionaires are tapping into free money and get the free lunch from the FED via dozens of schemes. Take the bailout for example. The bailout is not for the people/employees, it is for the super wealthy. In the past 6 years, US airlines spent $42.5bn on share buy backs (in my book, that is called burning your cash excess). And now that they do not have this money to cover for the crisis, they are asking for a $50bn bailout. See the logic? 🤔

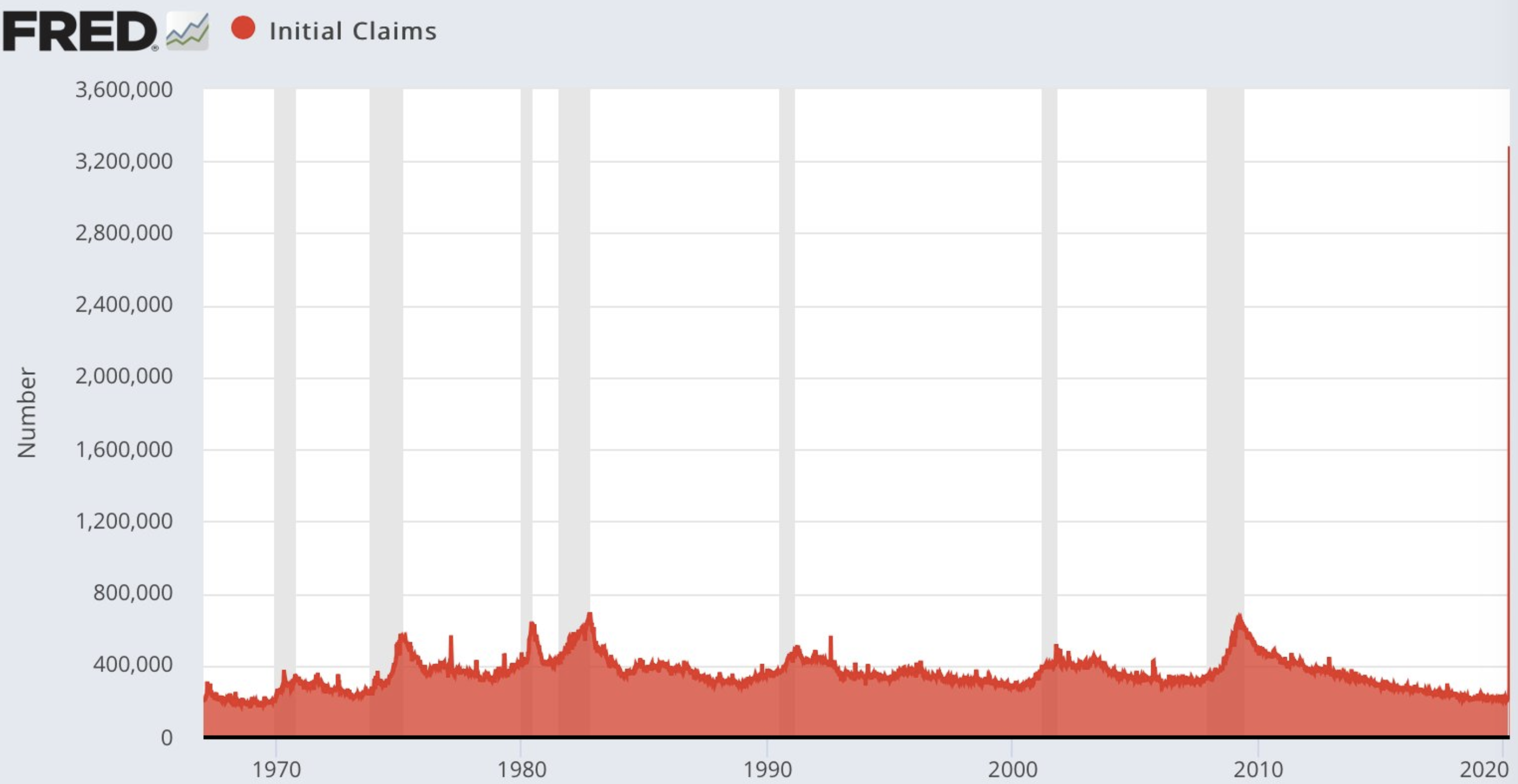

Anyway, back to the real deal. We are fast going into a depression. Every day or week that keeps us in this mess is converting into the same number of weeks or months of depression further down the line. World war III would not have triggered worse indicators. Here the unemployment claims in the US. If you do not see the apparent problem, look carefully at the thin red line on the far right of the graph, 3.3 million new unemployed last week. Nothing compares to this in modern history...

So if the depression is our roadmap, what is in store? Let's have a deeper look into 1929. We got the 35% plunge 🤕 in the past month ✅. We got the 25% rebound 🥳 in the past week ✅. Also, we got them faster. A week of 1929 takes like 2 days of 2020. So we can hope that the 10 years of upcoming depression of the 1929 script would last only a couple of years... We can hope... But the blueprint says: if you thought it was all over, think again. It's going to be a long drag into oblivion...

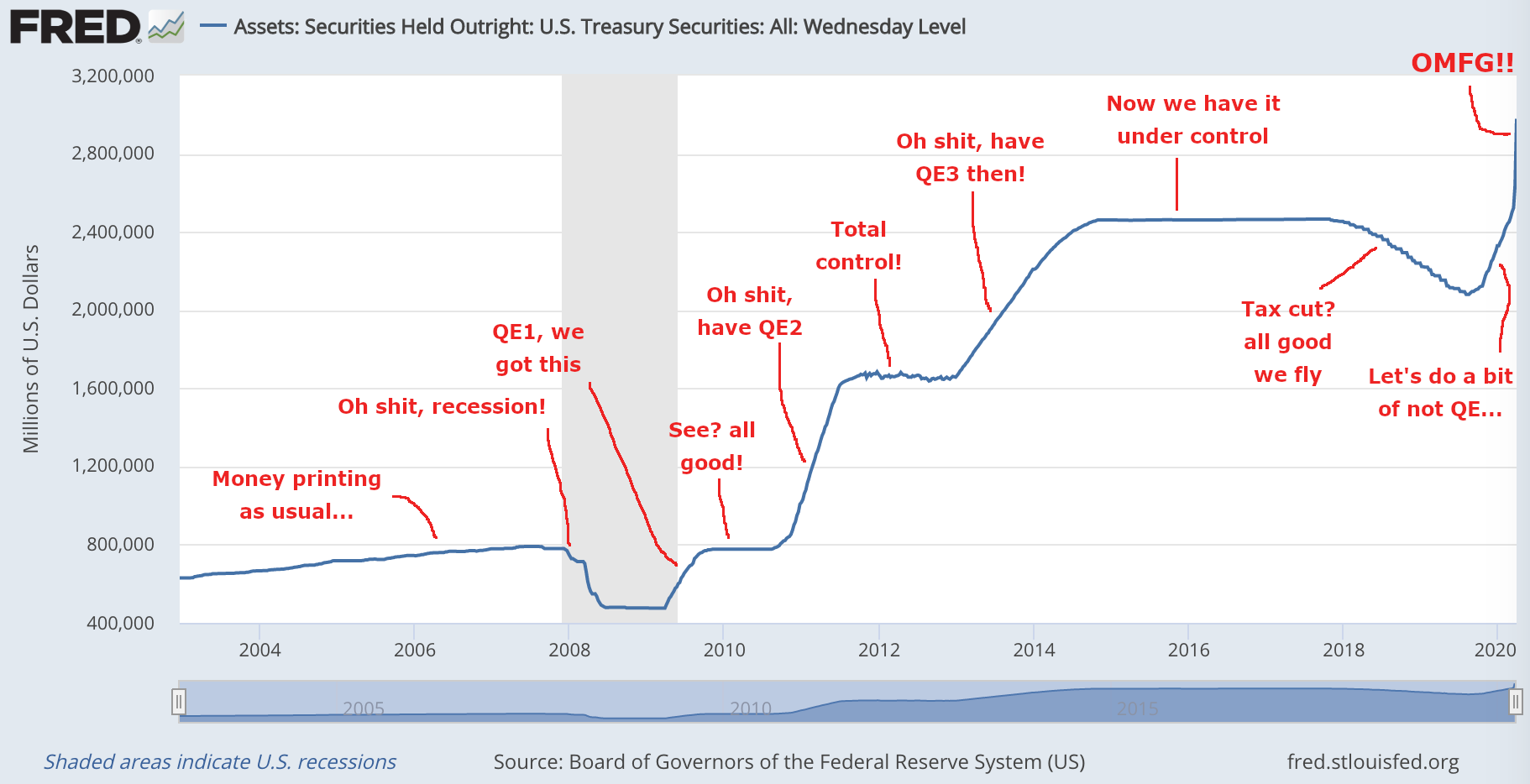

That is why the FED is fighting like there is no tomorrow. They are on a dangerous path which they navigate totally blindly. On one side, cardiac arrest and deflation, on the other side, hyper-inflation. They refuse to accept the depression script. So they print, print, print. The FED was a 16 year old organisation in 1929, only a teenager... In retrospect, in 2002, Bernanke (FED president at the time) said "Regarding the Great Depression, … we did it. We’re very sorry. … We won’t do it again". The FED is now 107 year old and portraits itself as a wise old man.

Hummm not sure if the picture above makes the FED look like a grown-up wise man to you... 😱 Money printing indeed goes hyperbolic, from billions to trillions... But the big difference with 1929 is not one of wisdom, but this: the FED now operates in a different world, where money is not attached to a monetary unit (gold as it was before 1971). Therefore, it can play the alchemist without limit. Then, as all fiat money in the world are linked to the USD mother of all fiat money, a few people on this planet get to decide the future of 7 billion others. The tiny path between deflation and hyper-inflation. The tiny path going uphill placing more future burdens onto everybody. The world of tomorrow will definitely be different. Do not get mistaken. The debt will have to be repaid, and it will require a lot of people working a lot of years and being taxed a lot of their hard work to repay it.

At some point in a not too distant future, we will win the health battle. We can also hope that we will have a time-compressed (hard but fast) depression and the economy will start growing again in a year or two. But the monetary and fiscal battles are the long lasting hurting ones, and at the moment, it's all up in the air with more uncertainty for the future than at most times in the past 100 years. Deflation or hyper-inflation? Or maybe both, one following the other...

I leave you with a positive though, the reassuring meaning taken from the year of the Jubilee, which is supposed to happen every 50 years. For sure, what we get now looks like a half century reset. But which kind of reset?

Any nation would receive a tremendous blessing if they observed the Jubilee! People would not ring up huge debt and there would be no great imbalance between the wealthy and the poorest. The value of land would stabilize and the usual giant ups and downs of the economy would not happen.

Amen! To your journey!