Oh, by the way... Wuhan got on the world stage for another headline this week. In the world of fake, this is quite some news. 83 tons of pure gold (let's call it a value of $2.5bn between friends) were in fact... gold plated copper bars 🤦. This is also between 4-5% of China's gold reserve, which appeared to be fake. Did it move the price of Gold? Not one bit.

A good thing there aren't too many more checks on other vaults, we could discover more hidden copper! At this rate, the price of copper will collapse if most of the gold is in fact copper in disguise and the market is inundated with tons of copper surplus... 😂

Just for reference, I give you below the official Gold reserve per country (top 7 only) as of last year. For those wondering why the U.K. superpower nation and ex world-empire is not even in the top 10 and lags behind Portugal and Kazakhstan, ask Gordon Brown 🤭... For those wondering why Switzerland is not putting more gold in its coffers, look at the Nasdaq chart. And finally, for those wondering why Russia is buying so much gold, you are asking the right question 🤫!

But of course, gold (real or fake) is not just sitting there in a vault. As it is not very convenient to pay anything in gold, we use fiat money instead. So this ancient relic of gold is mostly used as a collateral to create new money (debt) for a multiple of its value. If you or I pledge a gold ring, we will probably have a multiple of 0.5, meaning that we could get a short term loan of half the value of these few grams of gold. Of course, we would also pay 5, 10, or maybe 15% interest on this loan. Now, if a commercial bank pledges 1 ton of gold to its Central Bank, it will get a multiple of at least 10 (or in certain conditions up to 25-30), and in today's world, the loan they will get will be at a rate close to zero percent. Don't be angry at me, it's how it works...

Then, the bank will use this loan to lend money to you and me, at a rate of 2, 3, or 4%, and pocket the difference. In turn, one of these guys who got the loan at say 3%, will loan the same money at a higher risk to someone else at 10, 13 or 15%. Don't tell me it's an imaginary world, it's just what I did earlier this year in the pre-covid world and I explained it clearly here.

Therefore, these 83 tons of fake gold could have ultimately been underpinning many $billions of credit and risk, leveraged layer upon leveraged layer. We could easily be in the range of $25-50bn, or the size of the Brexit divorce bill once more 😉. Well, this week-end someone will have to undo the layers and write these off... Just a technical detail...

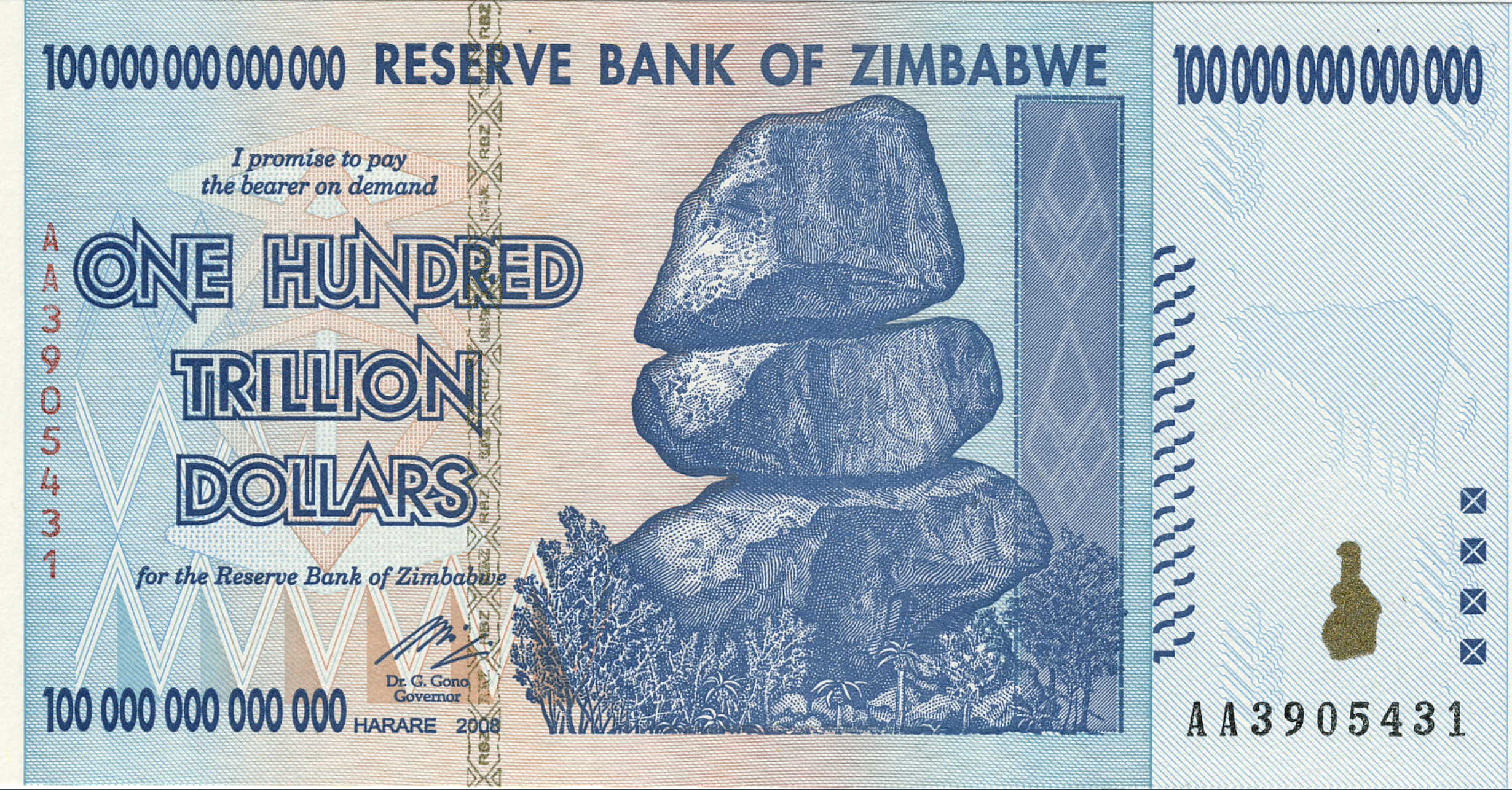

But as it happens, the world of Central Banks we live in is detached from Gold. Nowadays, the Fed can print $3tn (trillion) in 3 months and this is certainly not backed by gold. Well, in the fiat money system, it is only backed by confidence in the system. This is why it is very tempting to agree with most propaganda-economist and sensation-seeking media around us, that price inflation is going to the moon in the coming months/years. We have seen examples of this in many places, and it is quite ugly.

But we have also other counter examples.

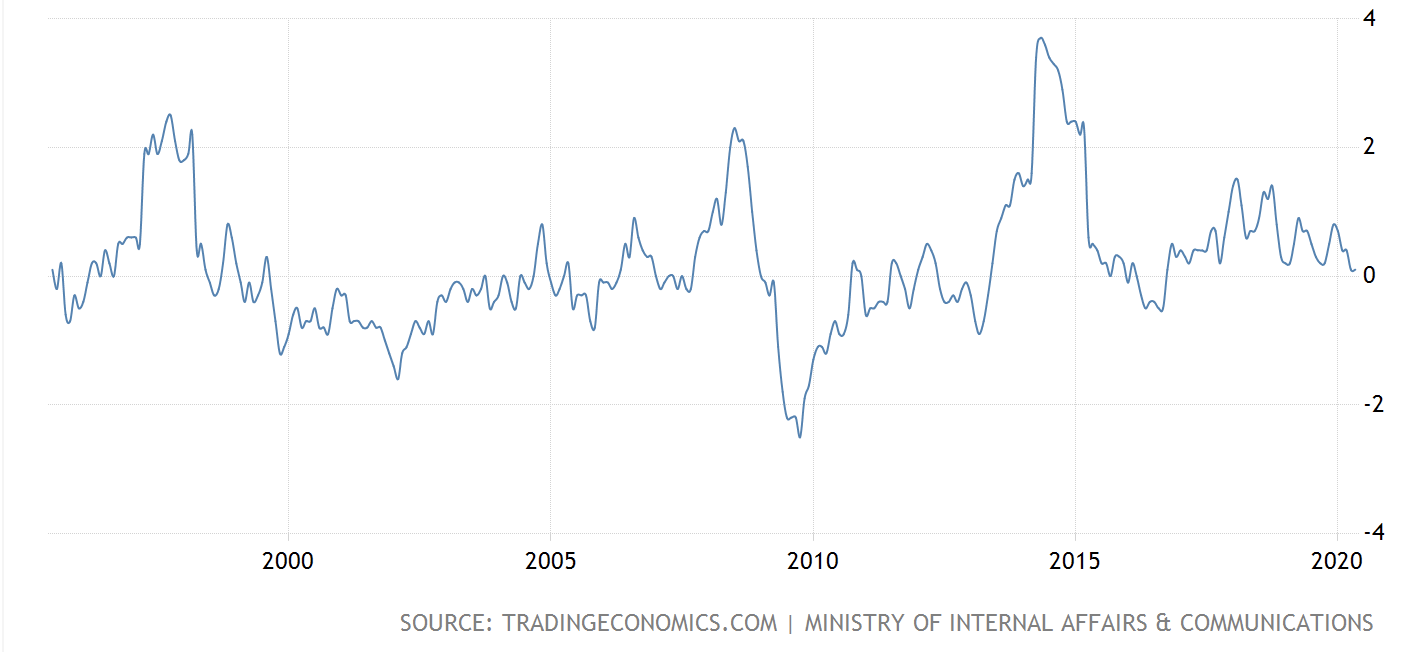

Below is the Japan CPI inflation over the past 25 years. Please bear in mind that during this 25 years of approximately 0% CPI average, the Bank of Japan went from having a balance sheet of less than ¥60tr in 1995 to more than ¥600tr in 2020. 1,000% is quite something in terms of explosion of money creation. But still... zero inflation...

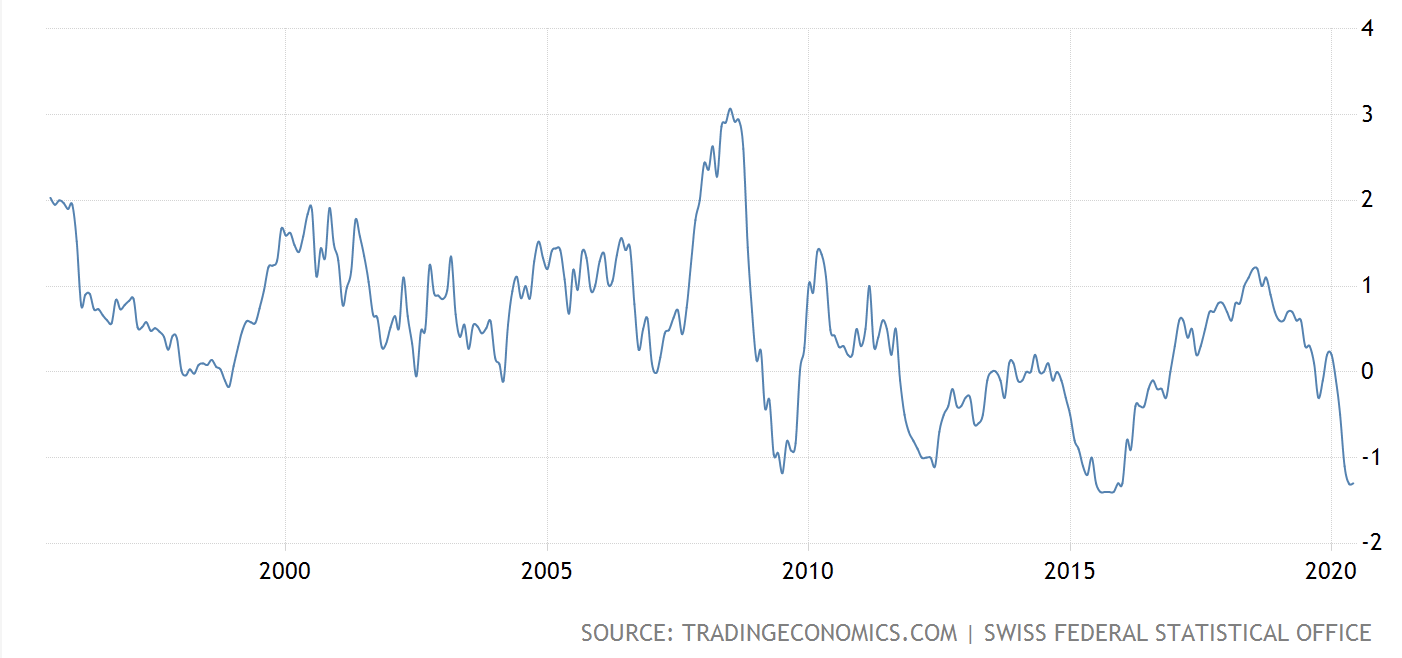

Or shall I show you switzerland? You know, the Central Bank who buys FAANMGs stocks instead of Gold... Again, let's have a look at the same 25 years CPI inflation chart. With an even more voracious money printing of circa 1,250%, starting at CHF 68tr in 1996 to CHF 918tr today, well... Still, zero inflation...

When you compare these two with the other major central banks of the world, it seems that there is still some way to go. And it looks to me that the Fed and the ECB are more comparable with the BoJ than with the Central Bank of Zimbabwe...

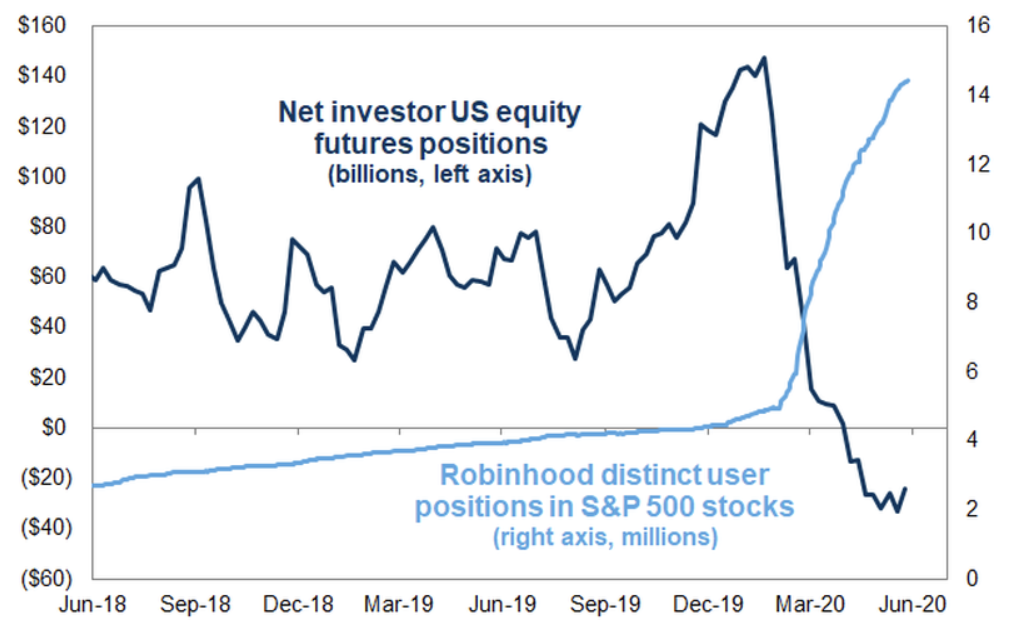

Of course, inflation is just not one size fits all, and certainly not just CPI. Of course, we have asset inflation. The money ends up somewhere, and there is this bubblesque asset inflation of the century on the stock market. Hey, these central banks have to put this money somewhere somehow...

As the market reopens on Monday, the investment boutique of Blackrock will make use of another $12.8bn of Fed money to invest it ALL on its behalf, before the market opens (pump it up), during market hours (maintain the level), and after it closes (pump it up again for the next day), but before they go back home for the day. Every day, with Fed money ad infinitum, they will continue to do their job of distorting the value discovery, this famous price vs value disconnect. The fact that they are attracting the lemmings closer to the precipice does not seem to be much in the equation. The Robinhood casino is OPEN and the state checks are put to good use...

You like this article? Please share it with your friends. I write for your benefit, not mine. Share it! 🙏

Follow me on twitter.

So, are we in for asset inflation and asset price distortion? Yes!

Are we in for CPI inflation?

Not so fast...

And we have not yet looked at the monster of the EuroDollar... 😱 Well, that will be for another post...

To your journey!