As a side note for those of you who are registered to this blog, I noticed that some of my posts are prone to be redirected to the spam box. I encourage you to verify your spam box and maybe check if you have not missed any post. So far, I always post an article over the week-end, so if you did not have one, it's in your spam... A good way to avoid future loss of email is to whitelist me as a sender.

So for the first time in two years, I decided to make an offer on a property. It's the type of property I like to buy. Abandoned but with good potential. Over the past 6 months, it went through auction 4 times, and 4 times, it did not sell. The last auction was this week, so it looks like it is ripe now. I visited it for the first time a couple of days ago. It ticks all the boxes in terms of being a good property with potential. But the price. And the yield. Oh my goodness, I have to rewrite my calculator to accept lower and lower returns. But this is where we are... Party, party, like there is no end in sight, because Fed Santa has got us covered (as well as his ass kicked by the King of US every week!).

So here is the deal: I have not even started renovating the last property I bought (not of my direct fault, still waiting for the bloody permit to renovate in a country more interested by party time than work time), that I already contemplate making an offer on another one, which will swallow a big lump of money. I got the secret memo (always ask the right questions). An offer just above £630,000 will very likely win. But I cannot... it screws up all my careful planning and cautious approach. So I sent a tentative bid only a mere 8% less. Not a big bargain, but hey, I think I could make it work if we continue to party like there is no tomorrow. By the way, if you have read the book Out of the Rat Race, you probably know that I sometimes make offers without having the funds. At this stage, it's just testing the water... I do not yet have the funds, but I made a passionate offer. Two minutes later, I am told that I am 4th in the queue (3 better offers within 24 hours) 😳 Bah!! There is really no end in sight to this party! I am not going to play ball, and I will let another one get their miserable return on it.

Which leads me back to the annoying dilemma we are faced with, courtesy of the King of US and the Fed.

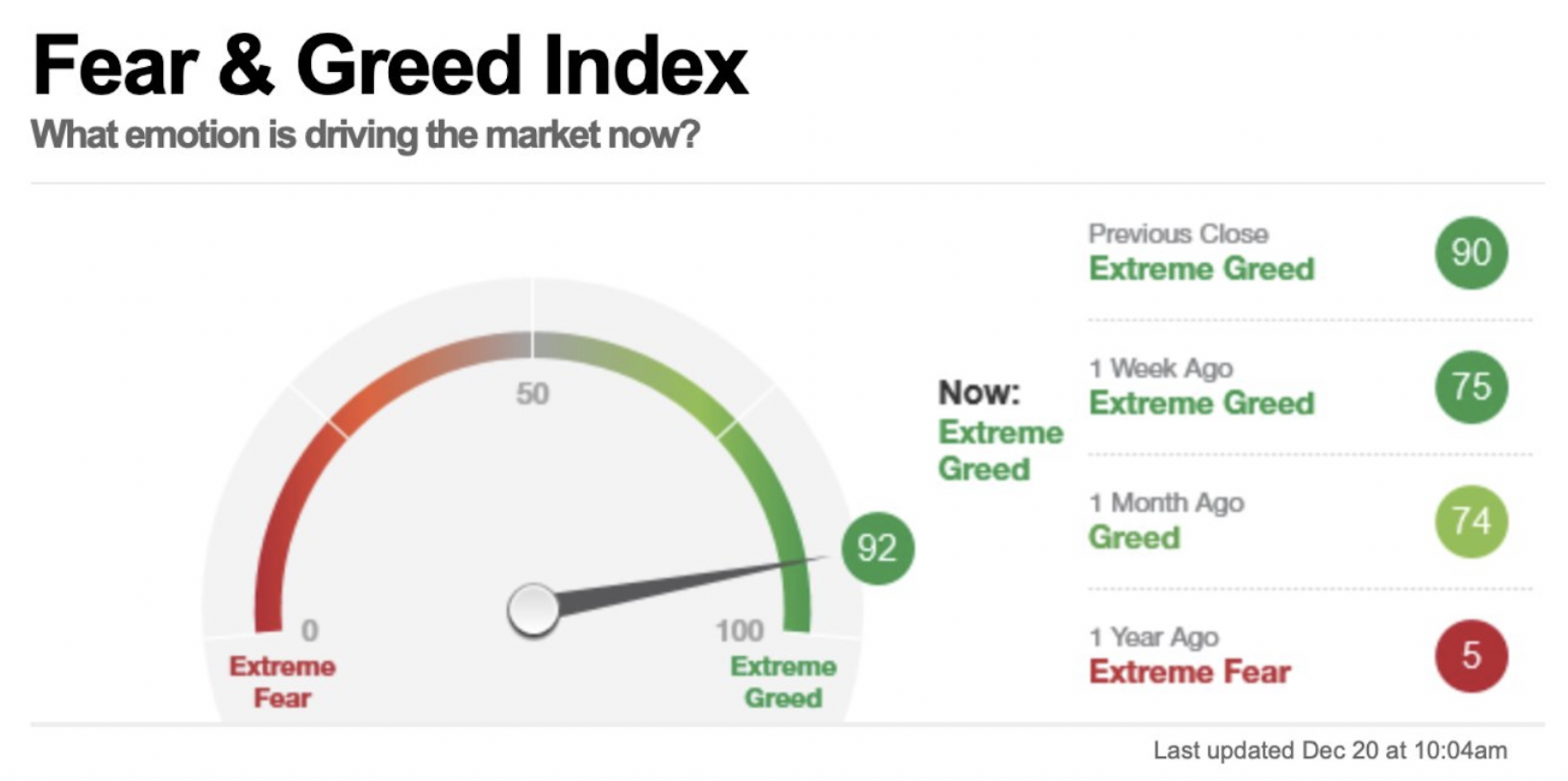

Look at this:

This was taken yesterday. The extreme fear and greed measure of the participants in the market. And as you can see... everybody is greedy! Extremely greedy!

And what about this one too?

We already talked about this in many ways in the past, but basically, large US companies get valued more (here on average 27% more than at the beginning of the year) whilst they earned less profit (here on average 4.5% less). Everybody is chasing ever diminishing returns (of profit) which makes the underlying asset soar. It does not make much sense, it does not inspire confidence into the future, but so far, and so long as the Fed has both the balls and the reigns, it is the world in which we live in. Everybody has the Fear of Missing Out and piles in. A guy called Warren Buffet once said be Greedy when everyone else is Fearful, and be Fearful when everyone else is Greedy.

My crystal ball is bipolar. One part is very clear and says we are reaching extreme greed, and this is a late stage before the storm. The other part is a tiny bit more blurry but it shouts out loud "who gives a F... 🤭" we will print our way out of this hole and inflate all that floats around us. Damn, I am starting to get bipolar too! Ahhh, this is so annoying!

In both cases we will get financial assets inflation, the rich will get richer, and the mega rich mega richer. But in the first case, we go through the bargain shop first, and we all have the option to get freebies for all the sins of the FOMOs. Getting all-in, or getting prepared...

To your journey!